Rare Earths Rising

Jun 12, 2025

While the headlines focus on trade tensions between the U.S. and China, savvy investors know the real story is about opportunity. Yes, tariffs remain high — up to 55% on Chinese goods tied to electric vehicles, batteries, and semiconductors — but that’s fueling a powerful push to build a stronger, more resilient supply chain right here at home and with trusted allies. China may still refine over 85% of the world’s rare earths, but that dominance is finally being challenged.

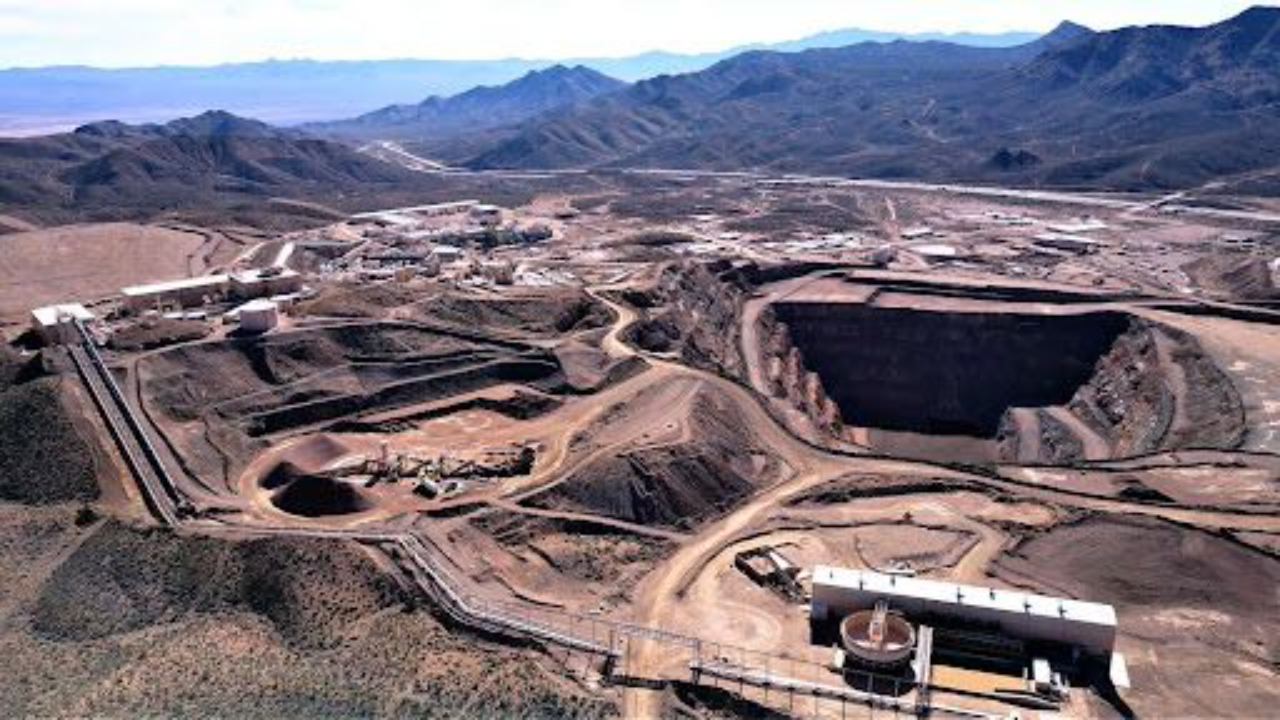

The good news? Companies like MP Materials (MP) are leading the charge, developing a full rare-earth supply chain from mine to magnet within the U.S., backed by strong government support. Australia’s Lynas Rare Earths (LYSCF) is scaling quickly as the West’s top non-Chinese processor, proving that alternatives exist and are growing. With billions flowing from the Inflation Reduction Act and the Defense Production Act to fund mining, refining, and critical technology, this sector is on the verge of transformation.

For investors wanting diversified exposure, ETFs like REMX (VanEck Rare Earth/Strategic Metals ETF) and LIT (Global X Lithium & Battery Tech ETF) provide broad access to this dynamic ecosystem that’s fueling everything from clean energy to defense tech.

This isn’t just about supply chain risk — it’s a once-in-a-generation chance to invest in the backbone of the clean energy and technology revolution. Think of rare earths as the steel and oil of today’s electrified economy: essential, strategic, and primed for growth. While the headlines talk “trade truce,” the real story is a global industrial reshuffle creating winners for years to come.

Bottom line: Rare earths represent a unique investment opportunity at the crossroads of geopolitics and innovation. For those focused on EVs, AI, and defense modernization, positioning in this space means tapping into one of the most exciting and impactful growth stories of the decade.