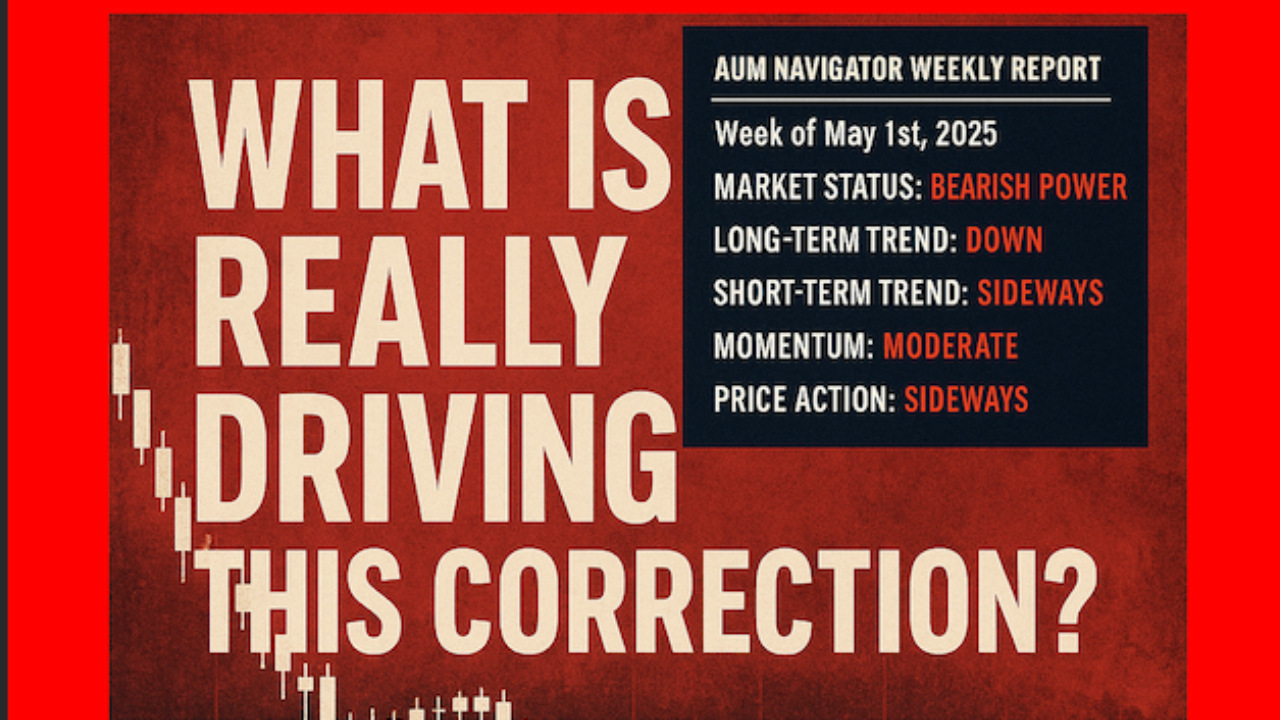

What Is Driving This Correction?

May 01, 2025

The Hidden Dangers Behind the Rally - What Is Driving This Market Correction?

Market Status: Bearish Power

- Long-Term Trend: Down

- Short-Term Trend: Sideways

- Momentum: Moderate

- Price Action: Sideways

The market feels strong on the surface — but underneath, it’s a pressure cooker.

This isn’t just about tariffs. It’s about a confluence of structural vulnerabilities quietly stacking risk across the system. Let’s break it down:

- Stock Market Vulnerabilities: Valuations are sky-high, and with rates rising and trade policy in flux, investor confidence in future earnings is cracking. As equities are sold off, volatility climbs and the tape gets heavier.

- Trade Policy & Tariffs: President Trump’s tariffs are reshaping the global supply chain, but they’re also stoking inflation and eroding confidence in the dollar. The greenback’s sharp slide is the market telling you it doesn’t like what it sees.

- Market-Driven Interest Rate Pressure: Even with the Fed standing still, markets are doing the tightening. Treasury yields are rising as inflation fears mount — a silent tax on consumers and corporations alike. Growth gets pinched, and the market starts to sweat.

- Yen Surge & Carry Trade Unwind: The yen is surging — a classic flight-to-safety move. As volatility rises, hedge funds that borrowed yen to chase yield are reversing course, dumping risk assets and fueling even more downside.

- Basis Trade Collapse: Highly leveraged hedge funds in the basis trade — arbitraging the spread between Treasury futures and bonds — are getting crushed as spreads widen. Liquidations hit, and the Treasury market absorbs the blow.

- Liquidity Stress: As Treasury markets flood, dealers can’t absorb it all. Regulatory capital constraints limit their ability to step in, and now liquidity itself is under threat. That’s when things start to break.

- The Feedback Loop: As prices fall and leverage unwinds, margin calls escalate. Selling begets more selling. Fear takes the wheel. What started as a few cracks becomes a contagion.

This is the kind of setup most investors never see coming — until it’s too late. But our members already know what time it is.

Right now, we’re comfortably sitting in fixed income — positioned for safety as volatility rips through equities and bear market rallies confuse the unprepared. We follow the charts, not the headlines.

If you’re still navigating based on mainstream noise, you’re flying blind. The AUM Navigator was built for moments like this — to guide serious advisors and investors through complexity with precision. Ask us how to get on board.